Mass. homebuyers pay hidden fees to lawyers for title insurance, with no state oversight

Early this year, Peter Ott and his partner sat at a table in their lawyer’s office, signing a thick stack of papers to buy their first home. Like most people, they agreed to a slew of closing costs.

Several big expenses had to do with the property title – reflecting the couple’s legal right to own the Dorchester property, and that no one else could lay claim to it. They had to buy insurance on the title to protect the bank, the lawyer explained. She also recommended they buy a second, optional, title insurance policy for themselves, just in case.

Together, the policies would cost close to $4,800. What the attorney didn’t say: Nearly 80% of that money would go to her law firm.

"The whole idea behind hiring the real estate attorney is they are representing you and your best interests."

Peter Ott

Ott’s experience is common across Massachusetts, where title insurance is a big money maker for lawyers and insurance companies. It's an opaque business with the lightest level of regulation in the nation. And in this state, title insurers pay large, hidden commissions to attorneys, WBUR found, and homebuyers unknowingly foot the bill. The charges are buried in the rush of the biggest financial transaction most people make.

“The vast majority of that premium that you pay is actually going back to your real estate attorney,” Ott said. Yet homebuyers have no way of knowing that, and lawyers don’t have to tell them.

“The whole idea behind hiring the real estate attorney is they are representing you and your best interests,” said Ott, 35. That’s from a legal perspective, he said, “but hopefully from a financial standpoint as well.”

In 2020, Massachusetts homebuyers purchased nearly $403 million of title insurance, according to the latest tally by the National Association of Insurance Commissioners. Across the country, title insurers took in $26 billion in revenue last year.

Very little of that money ever gets paid out in claims to cover legal battles over title conflicts.

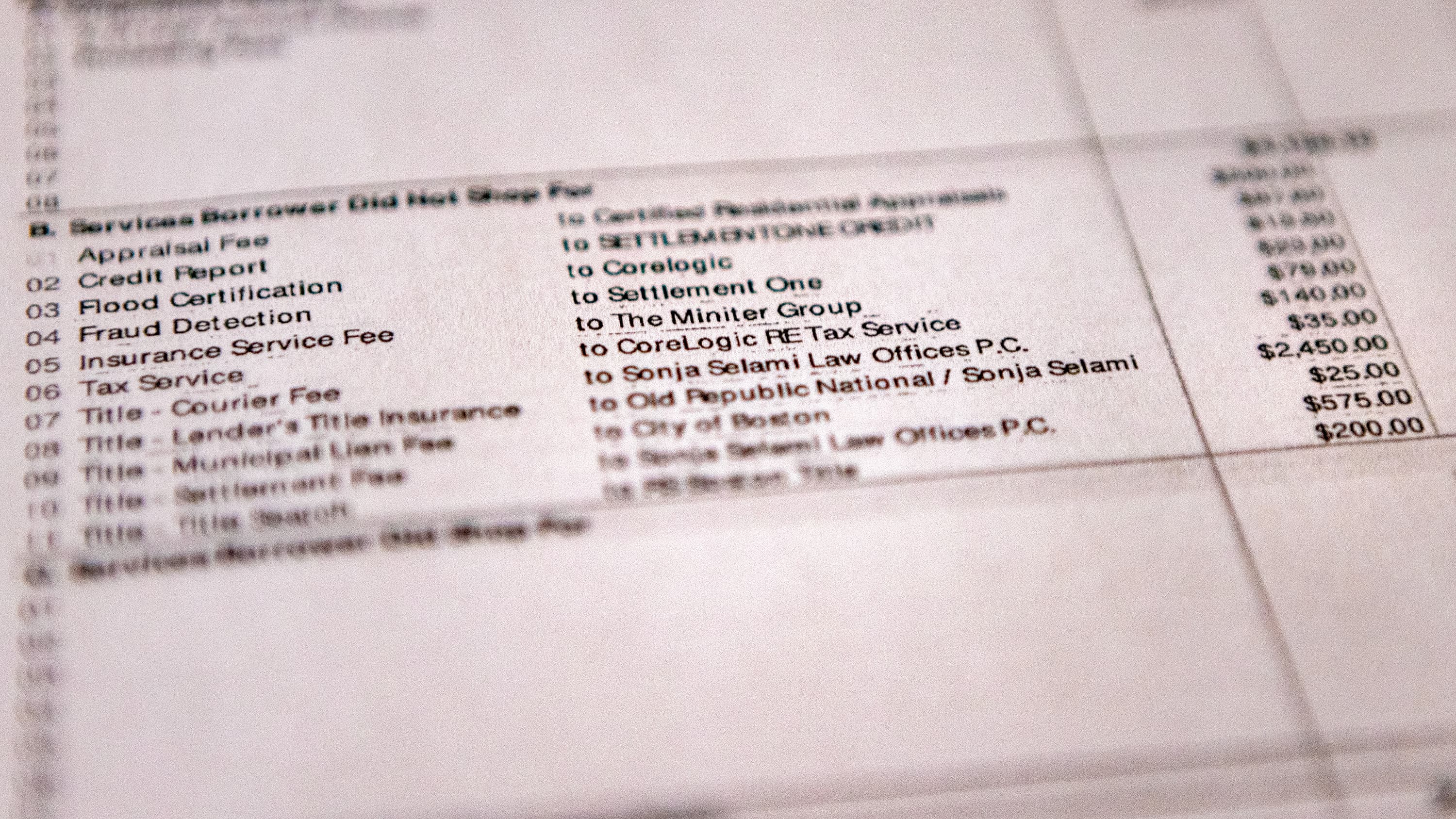

When Ott, an insurance actuary by profession, realized this, he went back to the lawyers who’d handled his closing to ask about the title insurance fees. In an email, he found out they’d earned about $3,800 of the $4,800 he and his partner had paid. That was on top of the lawyer’s charges of $200 for the title search, $575 for title settlement and $850 for personal representation.

Ott wound up feeling misled about his lawyer’s total fees and her advice on buying the optional policy. “They are definitely, on the face of it, double-dipping or triple-dipping,” he said.

The Wellesley-based firm he’d hired was Sonja Selami Law Offices, on the recommendation of his real estate agent. Selami declined to be interviewed by WBUR. In an email response to questions, she said attorneys are no longer required to disclose their portion of title insurance fees, after the federal government sought to simplify mortgage forms in 2015. She referred additional questions to a sales representative at the title insurer.

That insurance company is Old Republic National Title Insurance, a Tampa-based unit of Old Republic International Corp. in Chicago. On the closing document for Ott’s $1.2 million condo, Selami’s name appears next to the insurer’s. But Ott said he didn’t know that meant her firm was getting a cut of the title payments.

Old Republic officials declined to respond to any questions. The company is the third-largest of the four dominant U.S. title insurers. It reported $4.4 billion in title revenue for 2021, thanks to what was still a booming housing market, buoyed by low interest rates. The company paid out just 2.6% of its premiums on title claims, according to its annual report (vs. 64% for its combined lines of insurance, including property and corporate).

Hidden commissions

Lawyers wield almost total influence over which title insurance a homebuyer purchases. In general, consumers are not shopping for this product. Attorneys recommend which company to use for both policies – the bank’s and the buyer’s – and receive compensation from the insurer in return.

Critics say title insurance nationally is hugely overpriced. Bruce Marks, chief executive of Neighborhood Assistance Corp. of America, a Boston-based nonprofit that helps people with low and moderate incomes get mortgages, said a big factor driving up costs is the hidden commission arrangement for lawyers and, in other states, title agents.

“They get so much of what I call a kickback,” Marks said. “You can call it a fee. But I believe it's a kickback.”

Lawyers typically tell new homeowners they’re not required to buy the second insurance policy for themselves, but they highly recommend it. And few people have the courage to ignore a lawyer’s advice as they pay a median $710,000 in the Boston area, or far more, for a home.

“You already got your heart set on that house. So regardless of what they're going to put in front of you, you're going to sign it,” Marks said. “It’s the responsibility of the government and the regulators to push much more aggressively to get those prices down. It’s a scam, not just in Massachusetts. It’s a scam nationwide.”

"It’s a scam, not just in Massachusetts. It’s a scam nationwide."

Bruce Marks

Marks’ clients are spared the cost of typical closing fees because the lender picks up most of the expenses.

For instance, there’s Linda Jones, who worked hard to get approved for a mortgage and buy her first home in August of 2021 in Quincy. Had she gone with a standard mortgage broker, instead of Marks’ organization, the two title policies would have cost her $3,725. Instead she paid nothing.

Like many homebuyers, Jones said she didn’t know about the two title policies, or how much lawyers typically make on them. She was instead able to spend money to lock in a low fixed mortgage rate of 2.25%. “So, I feel lucky,” Jones said.

The federal Consumer Financial Protection Bureau removed the explicit disclosure of title fees when it overhauled mortgage forms in the wake of the financial crisis. While the goal was to make the process more understandable for consumers, omitting the title agent fees may have been an unintended consequence.

Raul Cisneros, a spokesman for the CFPB, in an email said the rules on disclosure “require fact-specific legal analysis,” depending on the state and circumstances. Officials at the consumer finance protection agency would not say whether Massachusetts lawyers are making adequate disclosures of their title fees.

"The reality is, if attorneys weren't getting a portion of the title insurance, our fees for representing borrowers and lenders would be significantly higher."

Noel Di Carlo

Attorney and title specialist Noel Di Carlo, who co-chairs the Real Estate Bar Association’s residential section in Massachusetts, said lawyers do a lot more than order up title searches. They draft purchase-and-sale agreements and review condo documents, she said, in addition to dealing with banks on mortgages and making sure paperwork gets filed. In her view, title insurance fees help pay lawyers for their work.

“The reality is, if attorneys weren't getting a portion of the title insurance, our fees for representing borrowers and lenders would be significantly higher,” Di Carlo said.

She said title insurance is important because it covers a homeowner’s litigation costs if a problem crops up with a title after a home sale closes. A seller may have construction liens or unpaid taxes on a property. A prior owner could have died and an heir could contest the will, making some claim of ownership. A neighbor can insist that five feet of a new owner’s yard is really his.

“If I see a deed from five years ago, I have no way of telling if that deed was signed fraudulently or if that person had any mental capacity to sign it,” Di Carlo said. If something like this were to go wrong, title insurance would cover it, she said.

At least that's what it's meant to do. There are scenarios where title claims are denied, and consumers have complained about some of those instances to the state attorney general.

Mistakes in title searches are relatively rare, title specialists said. There are outlier situations that may not turn up in a standard 50-year title search, but technology has wrung most of the errors and grunt work out of the process. Any problems that do surface with titles are typically resolved before a home transaction takes place; that’s part of the lawyer’s job.

Yet the purported risk of these occasional title problems is baked into the title insurance scheme.

Regulation of title insurance rates is light nationally. Federal housing regulators have left title insurance oversight to the states, resulting in a patchwork of rules and practices that have allowed title companies to charge high rates that don’t reflect the actual cost of the insurance, the Government Accountability Office reported back in 2007.

These many years later, across the country, title contracts between insurers and lawyers or agents are either never or rarely reviewed by most state insurance regulators, according to a 2019 survey by the insurance commissioners association.

When it comes to lax consumer protection, Massachusetts is one of about a half dozen states that doesn’t regulate title rates at all. The state also does not regularly collect data from title insurers, agents or lawyers.

Iowa stands alone with a different approach: It does not permit the sale of title insurance. Instead, the state guarantees a clean title for a flat fee of $175 for transactions up to $750,000. (It’s an additional $1 per $1,000 for more expensive homes.) In Iowa, Peter Ott’s title protection would have cost about $625. That’s a fraction of the $4,800 he paid here.

In New York, the State Bar Association’s latest ethical guidance on title fees, in 2013, said they should not be “excessive,” and that lawyers should disclose all fees to the client and not charge twice for the same work.

Nationally, the largest companies in the title insurance business saw windfalls during the home-buying and refinancing boom of the past several years. Fidelity National Financial Inc., a Fortune 500 company based in Jacksonville, Fla., that owns several title insurers, reported a 49% surge in revenue in 2021, to a record $15.3 billion. First American Financial Corp. of Santa Ana, Calif., saw a 30% climb, to a record $9.2 billion.

These big gains have benefited the companies’ investors, not customers. Last year alone, Fidelity National devoted more than $900 million to dividend payments and stock buybacks, to boost its share price and deliver returns to shareholders.

Title insurers have all this cash to spare because they pay out so few claims. Of the billions of dollars they took in for 2021, they spent less than 3% of that on claims from homeowners, according to the national insurance commissioners association. By comparison, property and casualty insurers spent 73% of their revenue on claims for losses like house fires and vehicle accidents.

The cost of title insurance is not tied to the complexity of the title search, but rather to the size of the mortgage for the bank’s policy, and to the sale price of the home for the owner’s policy. In just one example, First American Title’s online rate calculator shows that on a $750,000 house in the Boston area, with a $600,000 mortgage, it would charge $3,175 if both policies were bought together.

A 'lucrative' business with little oversight

The whole business of tracking titles goes back to Boston’s very beginnings as a city, in the 1630s. Just a handful of years after the settlers arrived in Massachusetts, they started squabbling over who owned what, according to Tom Ryan, first assistant register at the Suffolk Registry of Deeds.

“They formed what they called the Boston Book of Possessions,” to record property and transfers, Ryan said in an interview at the registry. He pulled an old volume from the rows of shelves and scanned the pages to look up Paul Revere. The famous American revolutionary had 15 property entries in the area from the late 1700s.

Old-school research like this can be time-consuming. But today, most residential title records going back to the ’80s can be done online. During the pandemic, this became particularly important, Ryan said, as far fewer title examiners came into the registry’s office to perform searches; instead, they did the job at home. A typical residential title search can be done “within a few hours,” Ryan said.

State Rep. Antonio Cabral, a Democrat from New Bedford, wants to reform title insurance in Massachusetts. He said he looked into the issue after some residents complained about it, and based on his own experience.

“It is one of the most lucrative insurance businesses. Not only in Massachusetts, throughout the country,” Cabral said.

For many other types of insurance, including health and auto, the state’s Division of Insurance reviews rates and policies to make sure they’re fair. But when it comes to title insurance, the division just licenses companies and monitors their financial stability, and little more.

A note on the division’s website warns consumers that title policies “are neither reviewed nor approved by the Division. You should read your policy carefully.”

Cabral said the lack of price transparency is unfair to consumers. He believes lawyers should have to disclose their fees and the state should be tracking and reviewing title insurance prices so consumers can shop and compare.

“At least the Division of Insurance should have the information, and that information should be available to consumers,” Cabral said. Officials from the Insurance Division declined requests for an interview.

Cabral has introduced bills many times over the past decade to reform title insurance. His measure would require insurers to file rates quarterly with the Insurance Division and would break out the lawyer’s commission in the cost. It also would ban insurers from charging homeowners for a new title policy if they refinance with their current bank.

But his bill has never made it past the hearing stage in the Legislature’s Joint Committee on Financial Services. He said he plans to refile the bill in the next legislative session in January, and may include additional reforms.

It won’t be an easy fight, Cabral said.

A WBUR review of the committee’s current members found that half of the 16 have had ties to the real estate industry, from holding brokers' licenses to appraisal jobs, according to their financial disclosure statements and an examination of their work outside the Legislature, as well as the work of their spouses.

Most of the lawmakers declined to comment on why they have not supported more oversight of title insurance. Rep. James Murphy, a Democrat from Weymouth who co-chairs the committee, said he hasn’t seen a community outcry over title costs, but the lack of regulation is "something we can look at.”

State Sen. Edward Kennedy, a Democrat representing the Lowell area, in an interview said he used to be a commercial real estate appraiser but was unaware of the inner workings of residential title insurance. He suggested the Insurance Division seek the power to oversee title insurance.

Bruce Marks, the mortgage advocate, puts the onus on state and federal regulators to lower costs for consumers and to push back on title insurance companies. He said, “The government has failed to adequately regulate this industry.”

WBUR's senior investigative editor, Christine Willmsen, contributed to this report.

This segment aired on November 15, 2022.